Johnson & Johnson MedTech announced the completion of the acquisition of Laminar, a privately held medical device company focused on eliminating the left atrial appendage (LAA) in patients with non-valvular atrial fibrillation (AFib). Johnson & Johnson MedTech acquired Laminar for an upfront payment of $400 million, subject to customary adjustments, with additional potential clinical and regulatory milestone payments in 2024 and beyond. Laminar joins Johnson & Johnson MedTech as part of Biosense Webster.

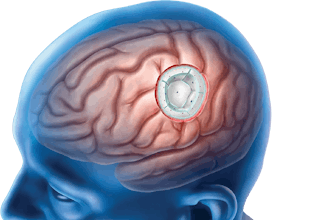

Unlike some commercial catheter-based procedure devices that use plugs to occlude the LAA, Laminar's approach uses rotational motion to eliminate the LAA. Laminar recently received FDA approval for the U.S. pivotal study, which will begin enrollment in early 2024.

LAA closure is an FDA-approved therapy for reducing the risk of thromboembolism in atrial fibrillation patients who are recommended for chronic oral anticoagulation therapy but have an appropriate rationale to seek a non-pharmacologic alternative to chronic oral anticoagulants. This is particularly important for the nearly 40% of AFib patients who cannot tolerate long-term blood thinners.

As a result of the acquisition of Laminar, Inc., Johnson & Johnson will be adjusting its expected Adjusted EPS for fiscal year 2023. The asset acquisition will require an in-process research and development charge which will reduce operational and reported Adjusted EPS by approximately $0.17 from guidance previously issued. The new expected operational and reported Adjusted EPS ranges for 2023 are now $9.85 to $9.91 and $9.90 to $9.96, respectively. Additionally, the asset acquisition is expected to have an approximate negative $0.15 EPS impact in fiscal year 2024.